Elon Musk, the tech billionaire who has often defied the odds, now faces one of the most sobering moments in his career. Tesla, once the undisputed leader in the electric vehicle (EV) market, has just reported its weakest quarterly performance in nearly three years.

The company’s global sales have dropped sharply, resulting in the loss of its long-held title as the world’s best-selling EV manufacturer.

This downturn has sent shockwaves through the auto industry and global markets, shaking investor confidence and raising serious questions about Tesla’s future direction.

For Musk, a man known for bold predictions and market-defying innovation, this unexpected decline could not have come at a worse time. As competition heats up and the EV market matures, Tesla is no longer the untouchable force it once was.

According to the latest financial disclosures, Tesla’s global deliveries for the most recent quarter fell significantly, reaching a level not seen since early 2021. This marks a stunning reversal for a company that had, until recently, been setting delivery records quarter after quarter.

Perhaps more strikingly, Tesla has officially been overtaken by a competitor as the top EV seller in the world. While Musk has not named the rival publicly, analysts widely believe that BYD, the Chinese EV powerhouse, has claimed the throne.

The immediate financial consequences of this sales slump are staggering. Tesla’s market capitalization has plummeted by approximately 68 billion dollars in the days following the announcement.

This represents one of the sharpest short-term valuation drops in the company’s history. The stock price, once a symbol of unstoppable momentum, is now under pressure, dragging down investor sentiment and threatening the wealth of shareholders, including Musk himself.

Tesla’s revenue for the quarter has also taken a significant hit. Compared to the same period last year, revenue has fallen by over 20 percent, translating to a loss of approximately 11 billion dollars in sales.

This decline is not simply a reflection of seasonal shifts or one-off disruptions. It is indicative of deeper issues facing the company as it struggles to adapt to an increasingly competitive and price-sensitive market.

Perhaps most personally damaging to Musk is the effect on his own net worth. Following the earnings release and the corresponding stock decline, Musk’s estimated personal wealth has dropped by nearly 17 billion dollars.

This has led to a slip in his position on the global rich list, further illustrating the severity of Tesla’s current challenges.

Several factors have contributed to this dramatic shift in Tesla’s fortunes. First and foremost is the intensifying competition in the EV market. Automakers from across the globe, especially those in China and Europe, have accelerated their production and released a flurry of new models designed to appeal to a broader range of consumers.

Many of these new offerings are more affordable than Tesla’s core lineup, and in many cases, they come with competitive features and government subsidies that Tesla’s vehicles no longer benefit from.

Consumers are also re-evaluating their priorities. The excitement around EVs remains strong, but there is growing demand for vehicles that are not only environmentally friendly but also affordable and practical.

Tesla’s vehicles, which have historically been positioned as premium products, are increasingly seen as out of reach for average consumers. While Tesla has introduced some pricing adjustments, they have not been sufficient to counteract the aggressive pricing strategies of rivals.

Moreover, production challenges have not disappeared. Although Tesla has made tremendous strides in manufacturing efficiency, the global supply chain remains fragile.

Shortages of key components, rising raw material costs, and logistic disruptions continue to hamper the company’s ability to produce vehicles at the scale and speed required to meet market demand. These issues have not only affected Tesla’s output but have also driven up costs, further squeezing margins.

The broader macroeconomic environment has also played a role. High interest rates, inflation, and tightening household budgets have made consumers more cautious about large purchases.

While EV adoption continues to grow, many buyers are now looking for value rather than brand prestige. Tesla’s competitors have capitalized on this shift, offering vehicles that meet these evolving expectations more effectively.

Tesla’s recent decline has implications beyond just the balance sheet. It challenges the perception that Tesla is the inevitable leader of the EV future. For years, the company has enjoyed a near-mythical status among investors, analysts, and the public. That aura of invincibility is now cracking.

Losing the title of top EV seller is more than symbolic. It suggests that Tesla’s lead has narrowed and that its competitors are not just catching up—they may be pulling ahead.

This shift also threatens the long-term strategic goals that Musk has outlined. Tesla’s ambitions include not only dominating the EV market but also revolutionizing autonomous driving, launching robotaxis, and producing futuristic models like the long-delayed Cybertruck.

Many of these initiatives are already behind schedule. With declining sales and reduced investor confidence, securing the funding and public support necessary to execute these bold plans becomes more challenging.

In response to the growing criticism, Musk has remained defiant. In a recent interview, he dismissed the downturn as a correction rather than a collapse. He emphasized Tesla’s ongoing investments in artificial intelligence and autonomous driving as keys to its future rebound.

Musk also hinted at the possibility of launching a lower-cost Tesla model aimed at recapturing market share among budget-conscious buyers.

While these reassurances may calm some nerves, the road ahead is far from smooth. Tesla must now navigate a complex landscape filled with new competitors, shifting consumer expectations, and macroeconomic headwinds.

Moreover, the brand must confront the reality that its once-clear dominance is now being contested on multiple fronts.

Tesla’s global brand power remains strong, and the company still possesses significant technological advantages in battery performance, software, and infrastructure. However, these strengths are no longer unique, and others are beginning to catch up.

Maintaining leadership will require innovation not just in engineering but also in pricing, customer experience, and supply chain resilience.

This turning point for Tesla could ultimately serve as a wake-up call. The EV market is no longer an open field. It is a crowded, fast-moving space that demands constant evolution.

Musk’s vision and leadership have brought Tesla to unprecedented heights, but sustaining that success will now depend on adapting to new realities and embracing more inclusive strategies.

For consumers, investors, and industry observers, the coming months will be critical. Will Tesla adjust its strategy and reclaim its dominant position, or will it continue to lose ground to faster, leaner, and more locally attuned competitors?

One thing is certain—Tesla is no longer alone at the top, and the fight for the future of electric mobility has truly begun.

News

“I Still Miss Him”: Dolly Parton Breaks Down Mid Song as Reba McEntire Joins Her for Heart Shattering Tribute to Late Husband Carl Dean.

“I Still Miss Him”: Dolly Parton Breaks Down Mid Song as Reba McEntire Joins Her for Heart Shattering Tribute to…

This guitar carried my soul on its strings when no one knew my name…

In the electric silence that follows a singer’s last note, when the world holds its breath in anticipation of what’s…

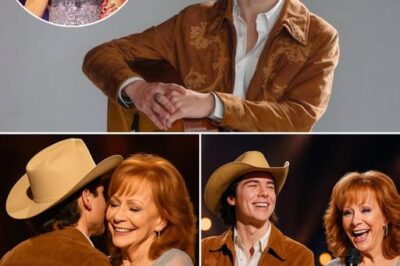

The Voice reveals 4 returning coaches for season 28 including Niall Horan and Reba McEntire

The duo will be joined by fellow show alums Michael Bublé and Snoop Dogg. Nial Horan and Reba McEntire on…

Reba McEntire: “Drag Queens Don’t Belong Around Our Kids”

Reba McEntire Sparks Controversy with Statement on Drag Queens and Children. Country music legend Reba McEntire has found herself at…

Reba, Miranda Lambert, & Lainey Wilson Debut Powerful New Song, “Trailblazer,” At The ACM Awards

“Trailblazer” Is A New Song That Celebrates The Influential Women Of Country Music’s Past And Present Reba McEntire, Miranda Lambert, and Lainey…

Jennifer Aniston made a surprise appearance with a dazed expression and an unresolved…

Jennifer Aniston is no stranger to the public eye. For decades, she’s been one of the most beloved faces in…

End of content

No more pages to load